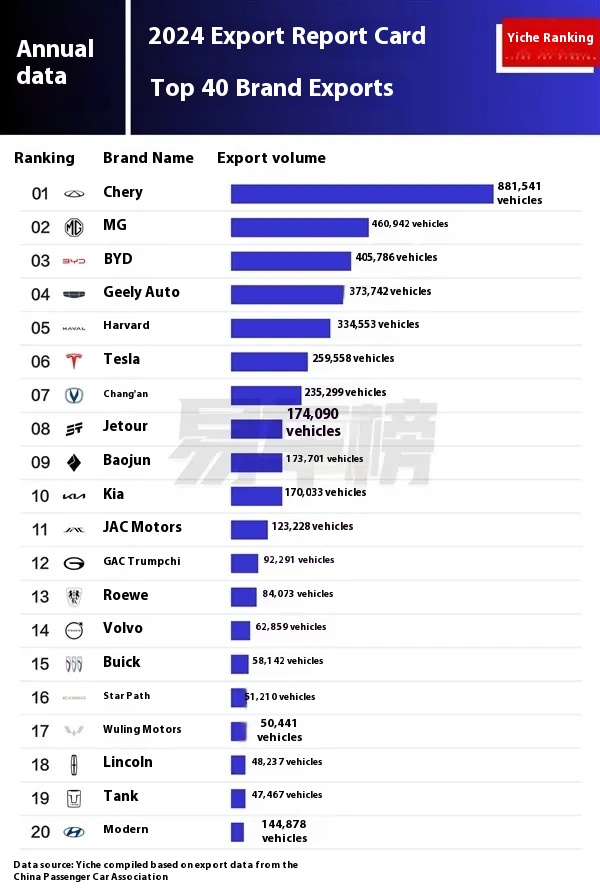

The top six overseas sales rankings of Chinese auto brands in 2024

1. Chery(Including Chery and JETOUR)

Overseas sales volume: 1.14 million units

Proportion: Close to half of its total sales

Main models: Tiggo 7 (with cumulative overseas sales exceeding one million), Tiggo 8, JETOUR Traveler

Market highlights: The Middle East and African markets have performed strongly, and the brand enjoys high recognition overseas, making it a benchmark for Chinese automakers as they expand globally

2. SAIC

Overseas sales: 920,000 units

Main brand: MG (Main model MG ZS, sales volume 160,000 units)

Market highlights: The European market performed exceptionally well (with 240,000 units sold in the EU), but it faced the challenge of high tariffs and generated considerable profits from the exchange rate difference.

3. Chang’an

Overseas sales: 536,000 units

Main model: CS55 (Export volume has doubled

Market highlights: The Southeast Asian and South American markets have performed exceptionally well, making CS55 an absolute pillar in overseas markets.

4. The Great Wall(Including Haval and tanks)

Overseas sales volume: 450,000 units

Main brand: Haval (sales volume: 330,000 units, main model: Haval First Love)

Market highlight: Despite being discontinued in China, the Haval First Love has achieved monthly sales of over 10,000 units overseas, with a high profit margin, demonstrating a “dimensional reduction strike” strategy.

5. Byd

Overseas sales: 430,000 units

Growth rate: Year-on-year growth of over 70%

Main models: Seal U (domestic Song Plus), Atto3 (domestic Yuan Plus)

Market highlights: The only brand dedicated to new energy, with a rapid growth momentum. Its best-selling domestic models are also popular overseas.

6. Auspicious

Overseas sales volume: 400,000 units

Main models: Monjaro (domestic Boyue L), Coolray (domestic Binyue)

Market highlights: The Middle East market is particularly popular. If brands from the Geely Group, such as Volvo, Proton, and Lotus, are included, the ranking might be even higher.

Summary:

Chery leads the overseas sales of Chinese automakers with an absolute advantage, followed closely by SAIC, which has broken through in the European market with the MG brand. Changan, Great Wall, BYD, and Geely have established a firm foothold in overseas markets through differentiated strategies (new energy, dimensional reduction strikes, and in-depth development of regional markets). Facing the fierce competition in the domestic market, the overseas market has become an important growth point for Chinese automakers. However, tariff barriers and an unfair competitive environment remain challenges.