Which energy source will dominate the world of commercial vehicles in the future

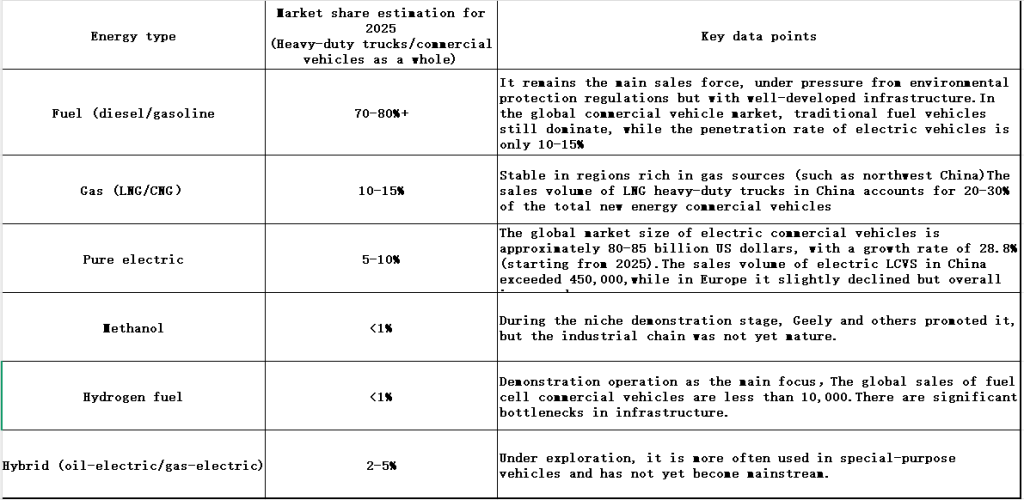

According to the 2025 market report, the distribution of energy types for commercial vehicles roughly conforms to your description: fuel (mainly diesel) still holds an absolute dominant position, while the share of new energy sources such as electric vehicles is small but growing rapidly. The following are estimates based on reliable sources (Note: These data focus on the global or Chinese market, with the proportion of China as a major commercial vehicle country) :

These shares are based on a synthesis of multiple reports: for instance, the electric commercial vehicle market started at approximately 80 billion US dollars in 2025 and is projected to reach 475 billion US dollars by 2032, with a CAGR as high as 28.8%. The global electric commercial vehicle market reached $ 70.9 billion in 2024 and is projected to reach $255.6 billion by 2030. (https://www.fortunebusinessinsights.com/electric-commercial-vehicle-market-113281)The total value of new energy commercial vehicles (including pure electric, hydrogen, and hybrid models) is expected to reach approximately $ 76.7 billion in 2024, with rapid expansion anticipated. However, the “original sin” of fuel (emissions) is being rapidly replaced by policies – such as the new emission standards of the European Union and China.

Which energy source will “dominate” the future commercial vehicle market?

I don’t think there will be a single winner. Commercial vehicles are not as easy to unify as passenger vehicles (heavy trucks have complex working conditions and high long-distance demands). The next 10 to 20 years will be a transitional period of “coexistence of multiple energy sources”, eventually tilting towards zero emissions. The following are my viewpoints, analyzed one by one, and supplemented with future predictions:

1 Fuel: Short-term king, but gradually fading away

Its core advantages lie in mature technology, long battery life, and convenient charging. At present, it is the dominant player (with a 70-80% share), especially in developing countries and long-distance logistics. However, environmental regulations (such as China’s National VII standard and the EU’s Euro 7) will make it increasingly “unable to hold its head high” – by 2030, the global share of fuel-powered commercial vehicles may drop below 50%, affected by oil price fluctuations and carbon taxes. In the future, it will retreat to remote areas or be part of a hybrid system, but it will not dominate.

2 Gas: Reliable replenishment, but not mainstream

It has good economic performance, superior emissions, and a stable share (10-15%) on specific routes (such as trunk logistics). The sales of LNG heavy-duty trucks in China are stable, but the scarcity of refueling stations and fluctuations in gas prices are the bottlenecks. In the future, as natural gas transitions to “green gas”, it may maintain its supplementary role, but the risk of being replaced by electric/hydrogen is high – especially if hydrogen infrastructure catches up.

3 Pure electric: A potential stock, suitable for dominating medium and short distances

You mentioned that its share is small (5% or lower), but its growth rate is astonishing. That’s very accurate. Advantages such as zero emissions, low cost, and policy dividends (subsidies, road rights) have made it shine brightly in fixed scenarios such as ports, urban distribution, and mines. BYD, Yutong, and others are leading the way, and traditional giants such as Jiefang and Sinotruk are also following suit. Future forecast: By 2030, electric commercial vehicles may account for 20-30%, especially in Europe and China (sales have exceeded 450,000 LCV). (https://www.virta.global/global-electric-vehicle-market) But life and charging pile problems (such as high power scarcity) make it difficult to master long, unless the battery technology (such as solid-state batteries). It will dominate the urban/regional market, but not the entire one.

4 Methanol: Marginal player, hard to make a name for itself

“Mysterious Player”. The convenience of liquid storage is a highlight, but low energy density, toxicity, and weak infrastructure are major drawbacks. Geely’s long-range models are the main force, but they are generally niche. In the future, unless there is a strong policy push (such as in coal chemical regions), it will be difficult for it to exceed a 1-2% share, and it will be more like a transitional experiment rather than a dominant player.

5 Hydrogen fuel: The ultimate solution, but the road ahead is long

The metaphor of “future warrior” is very apt! Zero pollution, fast hydrogen refueling, and long range are its trump cards for conquering long-distance travel. Yutong, Hyundai, and others are making plans, and the number of demonstration projects is increasing. However, high costs (vehicle prices, hydrogen prices, station construction) and a low proportion of green hydrogen are the biggest obstacles. Currently, the share is less than 1%, but it may rise to 5-10% by 2030, especially in heavy-duty long-distance travel. (https://www.catf.us/2023/03/why-the-future-of-long-haul-heavy-trucking-probably-includes-a-lot-of-hydrogen/, https://www.energy.gov/eere/vehicles/articles/hydrogens-role-transportation), the U.S. Department of Energy and NREL emphasize the role of hydrogen in heavy-duty trucks (https://www.nrel.gov/transportation/low-zero-emission-trucks), but it needs huge investment, such as filling stations built. It has the potential to dominate the long-distance market, but it won’t dominate the overall market in the short term.

6 Hybrid: Bridge Role, facilitating transformation

“Versatile in all directions”, that’s right – combining multiple sources, energy-saving, and flexible. However, the complexity and high cost of the system make it quiet in long-distance heavy-duty trucks. At present, more attempts are being made in special-purpose vehicles, with Great Wall and others exploring. In the future, it may account for 10-15% as a transition from fuel/gas to pure electric/hydrogen (such as hybrid heavy-duty trucks), but it will not dominate independently.

My overall view: There is no single dominant force. The two zero-emission giants (electric and hydrogen) are on the rise

The future commercial vehicle market will not be dominated by a single energy source, but rather by scenarios.

- Short intermediate/urban: Pure electric dominance (low cost, zero emissions).

- Long-distance heavy load: Hydrogen fuel or hybrid (high range requirement).

- Transition period: Fuel oil/gas will be maintained, but the share will shrink.

The driving factors include: policies (carbon neutrality goals, such as China’s carbon neutrality by 2060), technologies (such as increasing battery energy density to over 500Wh/kg), and infrastructure (charging/hydrogen refueling stations need to double by 2030).